|

|||||||||||||||||||

|

|

||

|

Articles Are you in need of some urgent cash? Easy payday loans online may be the solution. Have you got stuck with a large medical bill that you weren’t expecting or are you in need of some extra money just to buy a gift for your wife or your daughter? Well, almost everyone runs into some financial difficulties at some point of time, and when they do, nothing could be worse. Of course, most of these unpredictable situations demand huge sums of money, which is sure to cause you a good deal of stress and anxiety. It’s almost needless to mention the frustration you’ll feel to know the fact that you have money coming in, but you really need it right now. However, you have no reason to worry as long as you can avail the option of payday loans, which not only helps with overcoming your financial depressions but also puts a smile on your face! Read More...So what exactly is a payday loan and how does it help you in your day-to-day life? Well, a payday loan is nothing but a short-term loan that can be used when you need money ahead of your next paycheck. It’s seen that this option has become quite popular over the past few couple of years. In today's economic climate, it's more important than ever that people on low incomes have access to affordable credit options, so they don't end up with huge debt problems - and aren't driven to illegal loan sharks. Consumer Focus points this out in a new report that looks at financial inclusion and high-cost credit in other countries - France, Australia and Germany in particular - to see what we can learn from them. 'Mainstream banks,' the organisation's website states, 'must follow the lead of their overseas counterparts and do more to promote social lending to help fill affordable credit gaps in the UK.' While many people use payday loans in Canada to manage emergency situations, there are some other reasons why you might want to apply for them. In some cases, you may want to use them to expand your enjoyment of a particular occasion or create a more memorable one. At the very least, if you apply for payday loans in Canada, you will have a better chance of gaining your objective without falling short of money needed to pay routine bills. People are saving less and less. Credit card use is at an all-time high and short term bridging devices such as payday loans are becoming more and more prevalent. Spending is good for the economy. The multiplier effect means that a person who spends $100 is going to be injecting far more into the economy. But saving doesn't have to mean that money exits the cycle and the economy contracts.Saving can be done in the form of investing and this will see the money still there. For instance a person might build a house that they then rent out. They could buy shares in a company and the company will then have the benefit of those funds. They may buy government bonds and the government will in turn have the money at its disposal to do with it as it pleases. Read More...

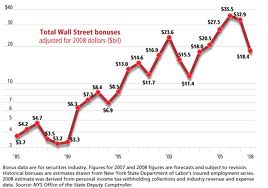

Meanwhile, Lloyd Blankfein and the leaders of Goldman Sachs increased their earnings 600,000 to $ 2,000,000. You read correctly: more than three times the salary of the year goes. Mr. Blankfein, after a year of “famine” has increased its bonus to $ 12.6 million up 43%. We could understand half so Goldman Sachs has seen its profits explode. On the contrary: the benefits of 2010 are down 38% compared to 2011. It is interesting to note that the pattern of activities of Goldman Sachs in London, Mr Sherwood (who does not seem to have the same values as Robin Hood!) Which affected 14.4 million dollars in bonuses, must still earn wages higher to meet the ratios in Europe. According to rough calculation, he probably “cash” $ 20 million. Recent research has show that close to 50 million pounds was paid out shareholders in the form of dividends, in many cases just a few days before the end of the tax year on April 6. Experts believe that many UK companies are employing this tactic as a means to help some of their big-income employees who are also shareholders to avoid the rise in the rate of income tax. If this is the case, it could cost the Treasury as much as £85 million pounds. Analysts estimate that the main "offenders" are directors in small to medium sized companies who want to minimise the effect of the soon to be effective 50 percent tax rate, due to their greater flexibility over returns. A rise in UK retail sales, albeit a minor one has been reported for March by the Office for National Statistics (ONS) According to the ONS, retail sales volumes during the month grew by 0.4% from February, which is less than the 0.6% analysts had expected. Sales improved in February after a very poor January, report with retail sales being hard hit by the icy weather. Financial panics are indeed dramatic and, for many private individuals and economic policymakers, traumatic. They are rarely of lasting significance to the fate of nations or their

|

|

|

Fiscal Study | Global Economy and International Politics : 2007 - 2010 | |

The Wall Street Journal blew the bomb: the amount collected by employees of the twenty-five largest Wall Street firms reached $ 135.5 billion. What is even more incredible is that this amount is greater than 2007, the year of all records. The crisis is definitely over for pay!

The Wall Street Journal blew the bomb: the amount collected by employees of the twenty-five largest Wall Street firms reached $ 135.5 billion. What is even more incredible is that this amount is greater than 2007, the year of all records. The crisis is definitely over for pay!